The 5-Year Rule Concept

The Social Security Disability 5-year rule is a product of the Social Security Administration’s (SSA) rules.

It stipulates that you must have worked and paid into social security for at least five out of the last ten years preceding your disability onset date.

Essentially, this means you’ve accumulated enough “quarters of coverage” to be eligible for benefits.

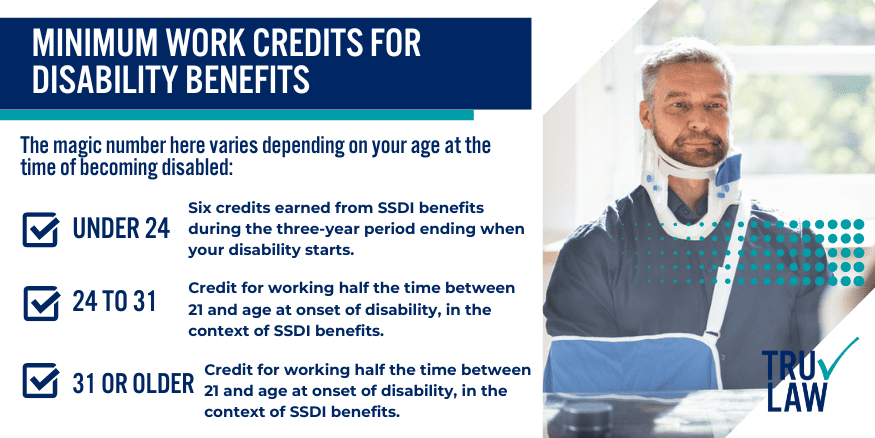

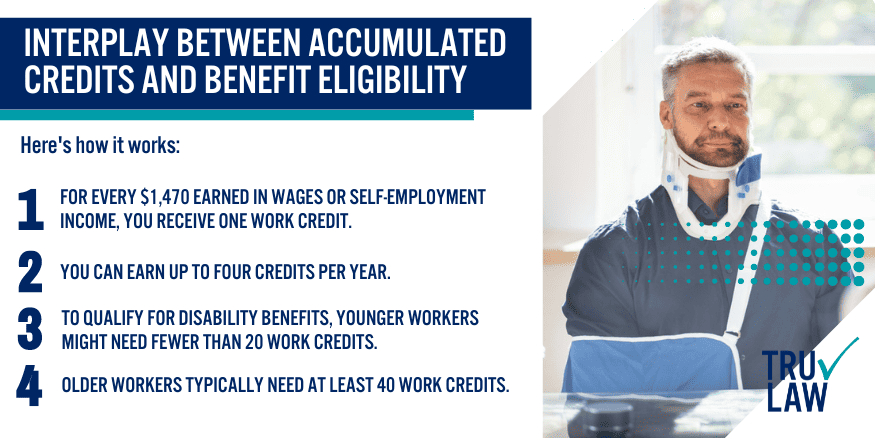

For each year you work and pay into social security benefits, you earn up to four quarters of coverage.

Hence, within a ten-year period, or forty quarters, you need twenty quarters (five years) to qualify for social security retirement under this rule.

It’s like a game where every quarter counts towards your retirement benefits! However, having a qualifying disability can also affect this.

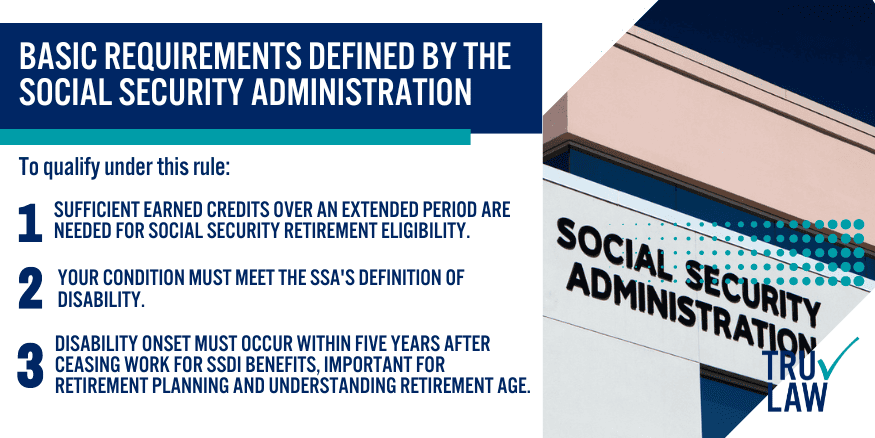

Basic Requirements Defined by the Social Security Administration

To qualify under this rule:

- You must have earned sufficient credits over an extended period, typically months, to meet the criteria for social security retirement.

- Your condition must meet SSA’s definition of disability.

- The onset of disability, impacting SSDI benefits, must fall within the five years after ceasing work, according to the social security administration. This is crucial to consider when planning social security retirement and understanding the retirement age.

This rule also ties in with the Social Security Administration’s (SSA) “Blue Book” listing of impairments and medical conditions that automatically qualify for SSDI benefits and SSD benefits, based on specific criteria.

Role in Determining Social Security Disability Benefits

The Social Security Administration’s rule helps determine if an individual has recent enough work history to receive SSDI (Social Security Disability Insurance).

If your working months are further back than the required five out of ten years, it may be harder to get approved for SSDI.

However, there’s an extended period where some exceptions apply depending on age, potentially opening the door for SSI (Supplemental Security Income) benefits.

Common Misunderstandings

Many misunderstandings surround this rule:

- It’s not about age: Some people think this is an age-related rule because it involves ‘years’. But nope! Irrespective of your age, if you haven’t worked enough months in the relevant time frame, qualifying could be tricky.

- Not just any five years: Another misconception is that any five working years will do — wrong again! The crucial point here is that they should be within the last ten years before becoming disabled.

- Exceptions exist: Many believe there are no exceptions to this hard-and-fast rule — but there are! For instance, younger workers might not need as many work credits.

So next time you browse through SSA’s website for SSI or SSDI benefits or receive a notice about the trial work period or how social security disability benefits work in April or any other month, remember:

Don’t let these misconceptions cloud your understanding!

Unraveling the complexities of SSDI benefits, SSI, and annuity can feel like solving a Rubik’s cube without instructions.

But once understood correctly, the Social Security Disability 5-year rule and the trial work period become less daunting and more manageable!